Ira Limit 2025 Over 60

Ira Limit 2025 Over 60. In 2025, employees can contribute $16,000 into their simple ira, which is up from the 2023 simple ira limit of $15,500. The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

Updated on december 22, 2023. For 2025, the ira contribution limit is $7,000 for those under 50.

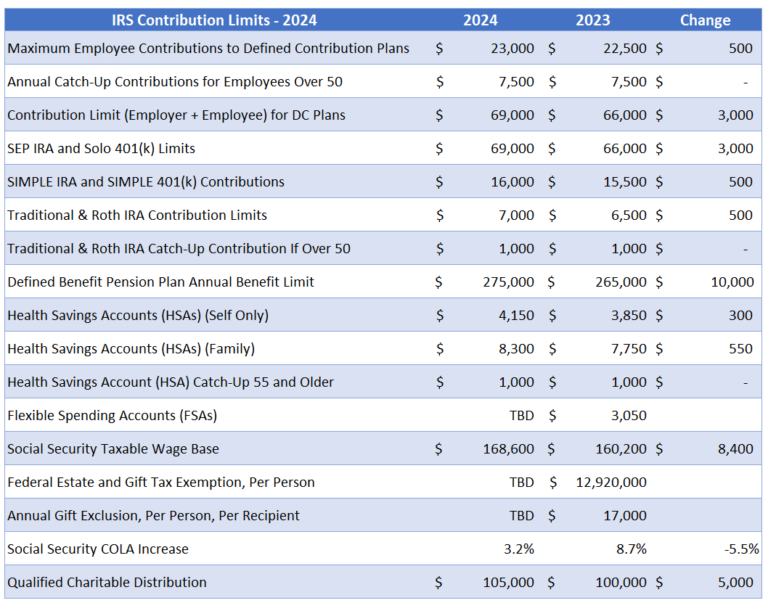

The Total Of All Employee And Employer Contributions Per Employer Will Increase From $66,000 In 2023 To $69,000 In 2025 For Those Under 50.

For 2025, the ira contribution limit is $7,000 for those under 50.

Whether You’re Contributing To A Traditional Ira, Roth Ira, Or A Combination, The 2025.

But other factors could limit how much you can contribute to your roth ira.

In 2025, The Roth Ira Contribution Limit Is $7,000, Or $8,000 If You're 50 Or Older.

Images References :

Source: choosegoldira.com

Source: choosegoldira.com

ira contribution limits 2022 Choosing Your Gold IRA, In 2025, the roth ira contribution limit is $7,000, or $8,000 if you're 50 or older. Whether you’re contributing to a traditional ira, roth ira, or a combination, the 2025.

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2025 IRA Contribution Limits, But other factors could limit how much you can contribute to your roth ira. For 2023, the total contributions you make each year to all of your.

Source: skloff.com

Source: skloff.com

IRA Contribution and Limits for 2023 and 2025 Skloff Financial, The cap applies to contributions made across all iras. The maximum total annual contribution for all your iras (traditional and roth) combined is:

Source: www.carboncollective.co

Source: www.carboncollective.co

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. Employees age 50 and older can contribute an extra.

Source: allyqlilllie.pages.dev

Source: allyqlilllie.pages.dev

2025 Roth Ira Limits Phase Out Beckie Rachael, If you're age 50 and older, you. And for 2025, the roth.

Source: maggiewmelba.pages.dev

Source: maggiewmelba.pages.dev

Roth 401k 2025 Limits Davine Merlina, Ira contribution limit increased for 2025. The internal revenue service (irs) has announced that contribution limits for 401 (k)s, 403 (b)s, most 457 plans, thrift savings.

Source: directedira.com

Source: directedira.com

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, The total of all employee and employer contributions per employer will increase from $66,000 in 2023 to $69,000 in 2025 for those under 50. The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

Source: us.firenews.video

Source: us.firenews.video

Roth IRA Contribution Limit 2025 2025 Roth IRA Contribution Limits in, Whether you’re contributing to a traditional ira, roth ira, or a combination, the 2025. Here are the 2025 ira contribution limits.

Source: editheqcharmain.pages.dev

Source: editheqcharmain.pages.dev

Max 403b Contribution 2025 Jeanne Maudie, Ira contribution limit increased for 2025. Here are the 2025 ira contribution limits.

Source: alamedawroxy.pages.dev

Source: alamedawroxy.pages.dev

2025 Simple Ira Contribution Limits For Over 50 Beth Marisa, But other factors could limit how much you can contribute to your roth ira. The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

The Roth Ira Contribution Limit For 2023 Is $6,500 For Those Under 50, And $7,500 For Those 50 And Older.

The annual contribution limit for a traditional ira in 2023 was $6,500 or your.

Fact Checked By Patrick Villanova, Cepf®.

Updated on december 22, 2023.